Building savings isn’t about being “good with money”—it’s about using a simple system that makes saving automatic and realistic. This beginner guide walks step by step from getting control of cash flow to building an emergency fund, cutting expenses without misery, and saving consistently even on a normal income.

Saving money can feel impossible when expenses keep rising or when your income feels “already spoken for.” The problem usually isn’t lack of effort—it’s that saving is treated like an afterthought instead of a built-in part of your money flow.

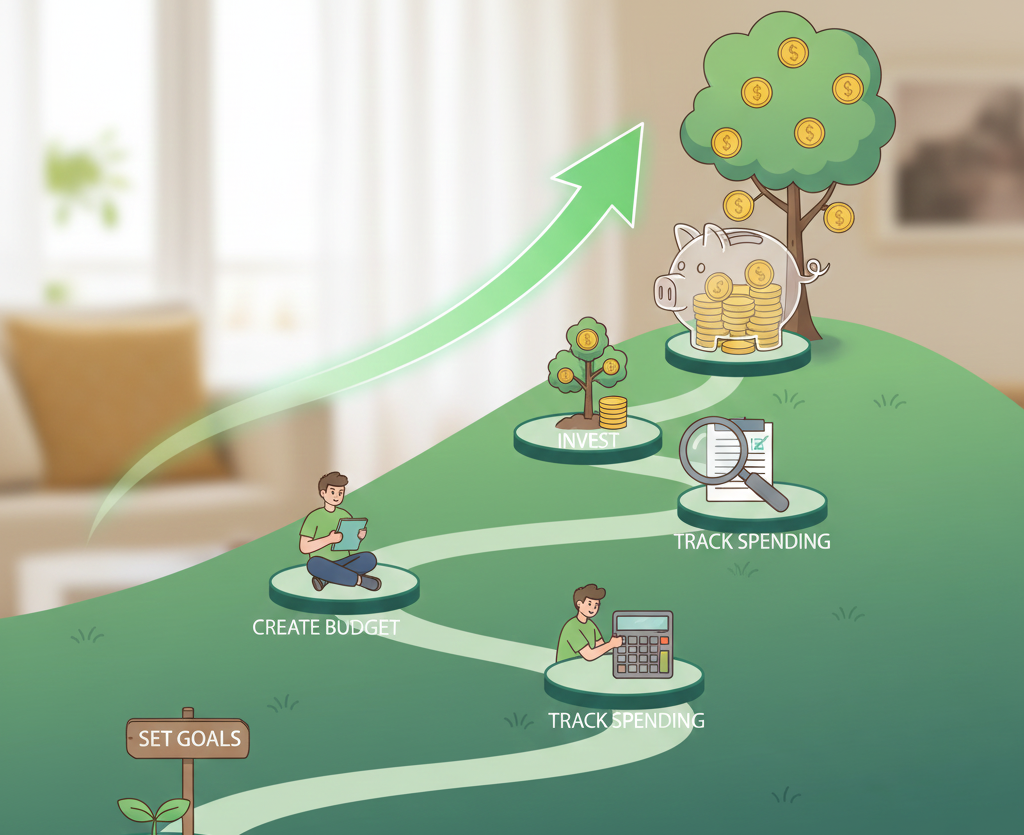

A practical saving plan is a sequence. You first create awareness and stability, then build a small buffer, then automate, and only after that do you optimize for bigger goals. This step-by-step approach helps beginners avoid the common trap of starting too strict and quitting.

This guide gives you a simple system you can set up in one weekend and maintain with a short weekly check-in.

Key Takeaways

- Saving starts with cash-flow clarity, not extreme frugality.

- A starter emergency fund reduces stress and prevents debt when surprises hit.

- Automation is the fastest way to save consistently without relying on motivation.

- The best expense cuts are “recurring leaks,” not essentials.

- A simple weekly routine keeps your plan working even when life gets busy.

Step 1: Define what you’re saving for (so it becomes real)

Most beginners say “I want to save money,” but vague goals don’t get funded. The first step is to turn saving into a specific target with a purpose and timeline.

Pick 1–3 goals (not 10)

Choose goals that matter most right now:

- Emergency fund (your foundation).

- A near-term goal (travel, a laptop, moving costs).

- A long-term goal (home down payment, investing, retirement).

Make goals measurable

Use this simple format:

- Goal: ______

- Amount needed: ______

- Deadline: ______

- Monthly savings required: ______

Even if you adjust later, this gives your saving direction.

Step 2: Find your “four money numbers” (the clarity step)

Before cutting anything, you need a quick snapshot of your cash flow. This reduces anxiety and helps you choose the right next move.

Gather these four numbers:

- Monthly take-home income (average the last 2–3 months if it varies).

- Monthly essentials (housing, utilities, basic groceries, basic transport).

- Minimum debt payments (if any).

- Current savings buffer (even if tiny).

This tells you whether your main problem is overspending, inconsistent income, high debt payments, or just a lack of system.

Step 3: Create margin (the rule that makes saving possible)

Saving requires margin: money left over after essentials and minimum obligations. If there’s no margin, you’ll “plan to save” but never have anything left.

Start with one “quick win” cut

Beginners succeed fastest when they start with a small, high-probability win:

- Cancel one unused subscription.

- Downgrade one service tier (streaming, phone plan, delivery memberships).

- Replace one weekly convenience habit (delivery, daily coffee, impulse buys) with a cheaper version.

Use spending caps for flexible categories

Instead of tracking every expense, cap 1–2 categories that often drift:

A cap is easier to follow than perfection.

Don’t cut essentials first

If you cut too hard (food, sleep, transport, basics), you usually rebound and overspend later. Focus on leaks and convenience spending before essentials.

Step 4: Build a starter emergency fund (stop the financial bleeding)

Many people can’t save because every surprise forces them to borrow, restart, and feel like they “failed.” A starter emergency fund breaks that cycle.

What it’s for (and what it isn’t)

An emergency fund is for unexpected, necessary, urgent costs. It’s not for planned purchases or routine bills you could predict.

Examples it should cover:

Starter vs full emergency fund

Beginner approach:

- Starter fund: enough to cover common surprises and reduce stress.

- Full fund: enough to cover multiple months of essentials based on stability and responsibilities.

Step 5: Automate savings (so willpower isn’t required)

Automation is one of the most reliable ways to save consistently. It turns saving from a monthly decision into a default behavior.

The basic automation setup

- Open a separate savings account (so it’s not mixed with spending).

- Schedule an automatic transfer for the day after payday.

- Start with a small amount you can sustain without stress.

- Increase it gradually every 30–60 days.

If income is irregular, automate a percentage of each deposit or save into a buffer first, then automate from the buffer.

Step 6: Use “sinking funds” for predictable costs (so they stop wrecking your month)

Some expenses aren’t emergencies—they’re predictable. Sinking funds are mini-savings buckets for those costs so they don’t push you into debt.

Common sinking funds:

- Annual bills (insurance, memberships).

- Gifts and holidays.

- Car maintenance.

- Health expenses.

- Travel.

Sinking funds make your finances feel calmer because fewer things “surprise” you.

Step 7: Reduce expenses strategically (without making life miserable)

Many saving plans fail because they focus on painful cuts that are hard to repeat. A better method is to target expenses that are high, recurring, and low-value.

The “3R” method: Reduce, Replace, Remove

- Reduce: keep the thing but use less (fewer deliveries).

- Replace: swap to a cheaper alternative (cook one extra meal).

- Remove: cancel completely (subscriptions you don’t use).

High-impact areas to review

- Housing (if change is possible over time).

- Transportation (insurance, fuel habits, unnecessary trips).

- Food (simple meal plan beats random snacks).

- Subscriptions and recurring charges (silent budget killers).

Keep it realistic: one change per week compounds over a year.

Step 8: Increase savings without “earning more” (behavior upgrades)

You can often save more without changing income by improving the system:

- Set bills to autopay to avoid late fees.

- Align due dates with paydays to reduce timing stress.

- Use a weekly check-in to catch drift early.

These are quiet upgrades, but they add up because they prevent mistakes and make saving consistent.

Step 9: Increase income (the beginner-friendly way)

Expense cuts have a limit. Income increases often unlock faster saving—but beginners should do it in a sustainable, low-risk way.

Options that don’t require a “new career overnight”:

- Sell unused items and direct the money to savings (one-time boost).

- Ask for extra shifts/hours short term (time-limited).

- Offer a simple service you can repeat (basic freelancing, local tasks).

The key is to treat extra income as “goal money,” not new lifestyle spending.

Step 10: Make saving stick (the weekly system)

Saving becomes easier when it’s maintained like a routine instead of a “project.” A short weekly review keeps you aligned.

20-minute weekly money check-in

Once per week:

- Check balances and upcoming bills.

- Confirm savings transfers happened.

- Review spending in your top 1–2 flexible categories.

- Choose one action: cut one leak, move money to savings, plan meals, or set a cap.

The “never miss twice” rule

Missing a week is normal. The rule is simply to restart the next week so drift doesn’t become a new default.

Common beginner mistakes (and how to avoid them)

- Saving whatever is “left over” instead of paying yourself first: automate it.

- Setting an unrealistic savings target: start smaller, then scale.

- Not planning for predictable expenses: use sinking funds.

- Cutting too hard: focus on repeatable changes.

- Tracking everything but not changing anything: make one small weekly adjustment.

Final Takeaways: Your Path to Smart Saving

Saving money step by step works when you follow the right order: get clarity, create margin, build a starter emergency fund, automate savings, and then optimize with sinking funds and smarter spending. You don’t need perfect discipline—you need a system that runs even when motivation is low.

Start this week with one move: set a small automatic transfer for the day after payday, or cancel one recurring expense and send that amount straight into savings. Small wins build the identity of a saver, and that identity is what makes bigger goals possible.

FAQ

How much should a beginner save each month?

Start with an amount you can automate consistently without causing stress or missed bills, then increase gradually every 30–60 days. Consistency is the first win; higher amounts come after your system is stable.

What if I’m living paycheck to paycheck—can I still save?

Yes, but start with tiny steps: find one expense leak, set one spending cap, and build a small starter buffer. The first goal is creating margin, even if it’s small.

Should I save money or pay off debt first?

Many beginners do best with a hybrid approach: build a small starter emergency fund first to prevent new debt from surprises, then focus on paying down high-interest debt while continuing small savings.

What is the best budgeting method for beginners?

The best method is the one you can repeat. Many beginners do well with category caps (instead of tracking every detail), plus a weekly check-in and automated saving.

What are sinking funds, and do I really need them?

Sinking funds are savings buckets for predictable upcoming expenses (annual bills, gifts, car maintenance). They help you avoid using debt for expenses that aren’t true emergencies.

How do I stop spending money impulsively?

Use system-based friction: remove saved cards from shopping apps, set a weekly cap for “fun spending,” and create a 24-hour rule for non-essential purchases. Then review it during your weekly check-in.

Where should I keep my savings?

A separate savings account is a simple beginner move because it reduces temptation and makes progress visible. The key is keeping it safe and accessible enough for your emergency fund needs.

What if my income is irregular?

Use a percentage-based savings rule (save a small percentage of each deposit) or build a buffer first, then automate from the buffer on a consistent schedule. This adapts saving to income variability.

How do I stay consistent when motivation drops?

Rely on automation and routines instead of motivation. A small automatic transfer plus a short weekly check-in keeps the habit alive even in busy weeks.

How can I save faster without sacrificing quality of life?

Focus on high-impact, low-pain changes: cancel unused subscriptions, reduce convenience spending, plan simple meals, and avoid fees. Combine that with small income boosts directed straight to savings.

Explicapramim is a blog dedicated to simplifying the world of finance in an accessible and practical way. Created by Rui Hachimura, the blog provides valuable tips on financial planning, investments, personal budgeting, and strategies to achieve financial independence. Whether you’re a beginner or someone looking to improve your financial knowledge, Explicapramim offers clear and actionable insights to help you make smarter money decisions.